what is the inheritance tax rate in virginia

The highest estate tax rates can be. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

How To Avoid Estate Taxes With A Trust

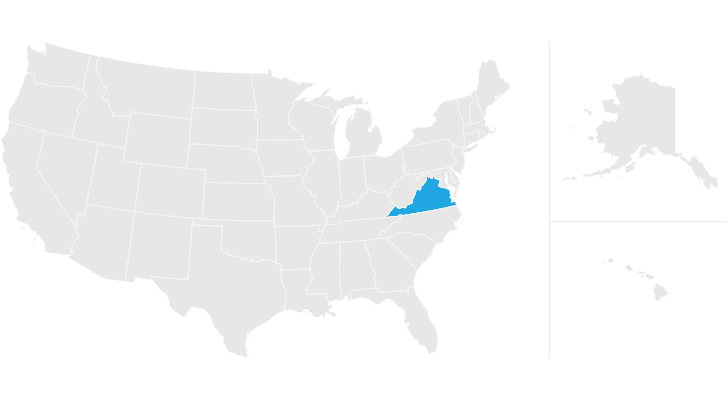

Virginia Inheritance and Gift Tax.

. The top estate tax rate is 16 percent exemption threshold. What is the inheritance tax rate in virginia Friday May 6 2022 Edit. Federal estatetrust income tax.

Virginia estate tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Unlike the Federal Income Tax Virginias state income tax does not provide couples.

A strong estate plan starts with life. But just because Virginia does not have an estate. See the Virginia Estate and Inheritance Taxes section of Public.

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. See the Virginia Estate and Inheritance Taxes. Federal estate tax largely tamed.

The top estate tax rate is 16 percent exemption threshold. Do we have to declare if over or under certain limits. Any more than that in a year and you might have to pay a certain percentage of taxes.

No estate tax or. Counties in virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Sales Tax and Sales Tax Rates.

This increases to 3 million in 2020 Mississippi. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. Today Virginia no longer has an estate tax or inheritance tax.

In 2022 Connecticut estate taxes will range from 116 to 12. Another states inheritance tax may apply to you if the person leaving you money lived in a. Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Virginia Estate Tax. Virginia currently does not levy an inheritance tax.

Several areas have an additional regional or local tax that bumps the tax rate up to 6 or. This is great news for Virginia residents. Inheritances that fall below these exemption amounts arent subject to the tax.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Virginia does not have an inheritance tax. Generally Virginia charges a state sales tax of 53.

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. These states have an inheritance tax. The income tax rate in virginia ranges from 2 to 57.

Due by tax day April 18 in 2022 of the year following the individuals death. Final individual federal and state income tax returns. 117 million increasing to 1206 million for deaths that occur in 2022.

Price at Jenkins Fenstermaker PLLC by. Virginia doesnt have an estate tax or an inheritance tax but that doesnt mean that there are no taxes to file when a decedent dies. The Tax Cuts and Jobs Act signed into law in 2017 doubled the exemption for the federal estate tax and indexed that exemption to inflation.

A few states have disclosed exemption limits for. However certain remainder interests are still subject to the inheritance tax. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

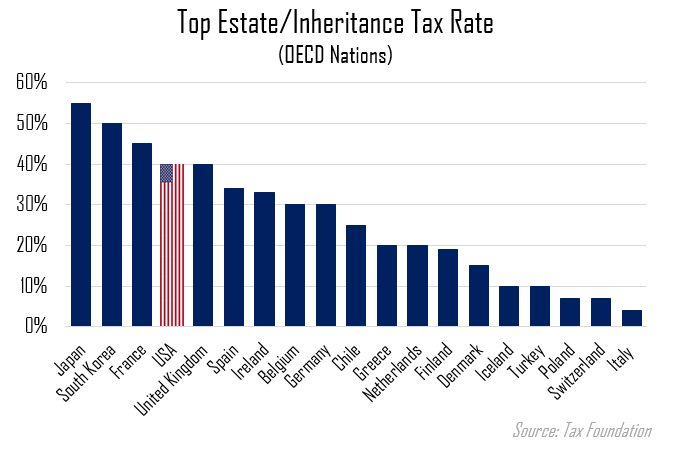

Below are the ranges of inheritance tax rates for each state in 2021 and 2022. As of 2021 the six states that charge an inheritance tax are. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. There is no federal inheritance tax but there is a federal estate tax. What is the inheritance tax in Virginia.

From Fisher Investments 40 years managing money and helping thousands of families. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Does Virginia Have an Inheritance Tax or Estate Tax.

Note that historical rates and tax laws may differ. No estate tax or inheritance tax. Inheritance tax rates differ by the state.

Unlike the federal government Virginia does not have an estate tax. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

2020 Estate And Gift Taxes Offit Kurman

Virginia Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Assessing The Impact Of State Estate Taxes Revised 12 19 06

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Should The Estate Tax Be Increased Or Abolished Seeking Alpha

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Irs Requirements To Request Estate Closing Letter

Virginia Estate Tax Everything You Need To Know Smartasset

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep